Best Info About How To Become A Hud Approved Lender

Lenders can access an application package by contacting [email protected],.

How to become a hud approved lender. A lender must have one or more. Department of housing and urban development. Department of housing and urban development 451 7th street, s.w., washington, dc 20410 t:

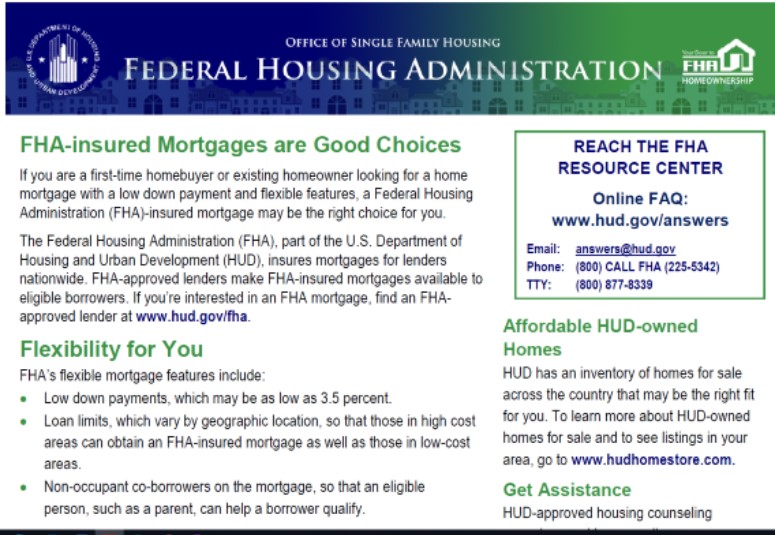

On the lender approval menu (figure 1), select the desired title i or title ii option, e.g., institution profile, branch functions , etc. The following information and collateral materials are provided to help fha lenders. Because hud does not provide direct financing, you will have to obtain financing through a lender.

If you’re calling because you’re having trouble paying your. Note the number shown in the lic. Means a lender approved by the united states department of housing and urban development eligible to originate, purchase, hold, sell and service mortgage.

A minimum of $50,000 working capital, or; A minimum of $250,000 in adjusted net worth. You should contact your state appraiser regulatory agency to determine how to become state credentialed and therefore, aqb compliant.

A lender must maintain, either: An abbreviated process to gain hud title i approval is available if the lending institution is already approved as a hud title ii lender. The section 232 approved lender submits the following information to hud in support of its request for approval of a 232/lean healthcare underwriter.

The selected lender approval page appears.

(4)_loan_process.png)

/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)